Can Trump fire Fed chairman Jerome Powell? This question has generated considerable debate among legal experts, economists, and market analysts alike. The relationship between President Trump and the Federal Reserve Chair has been fraught with tension, particularly regarding monetary policy decisions and interest rate adjustments. With Trump’s assertions that the Fed’s policies hinder economic growth, the potential for his intervention raises alarms about the Federal Reserve’s independence. Understanding the implications of a possible Fed chair removal is crucial, given the impact on U.S. markets and the future of fiscal policy under Trump.

The discourse surrounding whether a president can dismiss the chair of the Federal Reserve has sparked significant conversation in financial circles. With President Trump’s ongoing negotiation of economic strategies, questions arise regarding the governance and authority of the Federal Reserve. This topic encompasses concerns about the independence of central banking, the ramifications of appointing a new leader, and the overarching influence on monetary strategies. As the nation observes the dynamics between political leadership and economic stability, the ramifications of executive actions concerning the Fed’s command become increasingly pertinent. Recognizing these complex factors helps illuminate the potential outcomes associated with a shift in leadership at the helm of the central bank.

Can Trump Fire the Fed Chairman?

The question of whether President Trump can fire Federal Reserve Chairman Jerome Powell is complex and intertwined with interpretations of the Federal Reserve Act of 1913. Legally, while governors of the Federal Reserve can be removed for cause, there is ambiguity regarding the FOMC chair’s position, especially after his recent term confirmation. This has sparked debate among legal scholars about the constitutional powers vested in the President over independent agencies. Essentially, it boils down to whether a President can remove an individual performing executive functions at an independent agency without a clear cause defined in the law.

Recent legal precedents suggest that the Supreme Court may lean towards expanding executive authority, though the Federal Reserve could remain an exception due to its unique role in economic stability. The implications of such a move would likely destabilize markets, undermining the perception of Fed independence. Consequently, while the legal framework leaves some room for interpretation, the potential market repercussions may serve as a compelling reason for Trump to reconsider any plans to oust Powell.

Frequently Asked Questions

Can Trump fire the Fed chairman Jerome Powell?

Yes, Trump can theoretically fire the Fed chairman Jerome Powell, but it is a complex issue. The Federal Reserve Act allows for the removal of governors for cause, but the specifics regarding the chair are not clearly defined. Such an action could significantly undermine the Federal Reserve’s independence and is likely to provoke a tumultuous market reaction.

What are the legal grounds for Federal Reserve chair removal by Trump?

The legal grounds for removing the Fed chair like Jerome Powell stem from interpretations of the Federal Reserve Act, particularly its provisions on ‘for cause’ removal. However, the interpretation of this law can be debated, especially in light of recent Supreme Court decisions that question the extent of executive authority over independent agencies.

What impact would a Fed chair removal have on the economy?

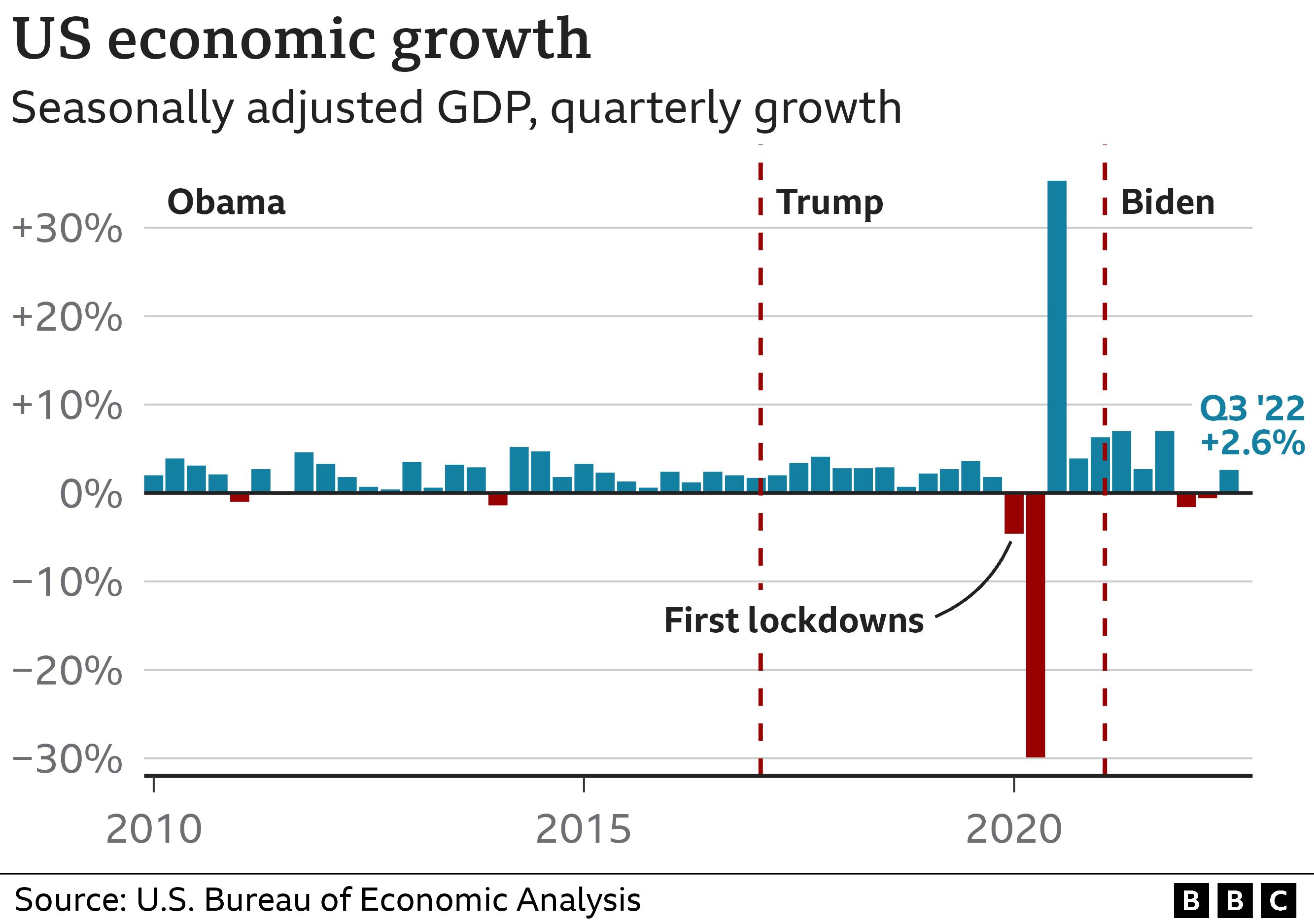

The removal of Fed chair Jerome Powell by Trump could have severe implications for economic stability. Markets fear that such a move could lead to a shift toward looser monetary policy, raising longer-term interest rates and undermining the Federal Reserve’s credibility as an inflation fighter. This uncertainty could disrupt financial markets and economic growth.

How does Trump’s conflict with Powell affect monetary policy?

Trump’s conflicts with Powell highlight a tension between governmental influence and the independence of the Federal Reserve. Trump’s desire for aggressive monetary policies may clash with Powell’s more cautious approach, impacting decisions around interest rates and inflation, thereby affecting overall economic conditions.

Is Federal Reserve independence at risk under Trump’s administration?

There is concern that the Federal Reserve’s independence is at risk under Trump’s administration, particularly if he were to remove Jerome Powell. Such actions could set a precedent that undermines the autonomous functioning of the Fed, which is critical for stable monetary policy and economic management.

What could happen to monetary policy if Trump replaces Powell?

If Trump were to replace Powell, it is expected that the new chair might adopt a more accommodative monetary policy aimed at short-term economic growth. However, this could lead to inflation fears and result in volatile market conditions as investors react to the shift in monetary strategy.

Did Trump ever hint at firing Powell; if so, what were the implications?

Yes, Trump hinted at firing Powell during his presidency, which caused significant market volatility. Such threats raised concerns about the integrity of the Federal Reserve and its independence, with many analysts warning that any move to oust Powell could be detrimental to investor confidence and economic stability.

What are the ramifications of Trump’s potential action against Powell?

The ramifications of Trump’s potential action against Powell could include increased market instability, loss of investor confidence, and potential long-term adverse effects on the economy. A removal could also prompt legal challenges regarding the limits of presidential authority over independent federal agencies.

Will the Supreme Court support Trump’s decision to remove the Fed chairman?

It is uncertain whether the Supreme Court would support Trump’s decision to remove the Fed chairman, as recent rulings indicate a possible erosion of the protections for independent agencies. However, significant legal complexities regarding executive power and the independent status of the Federal Reserve would likely arise.

What is the market’s view on the potential removal of Powell?

Markets generally react negatively to the potential removal of Powell, as they worry about the implications for monetary policy and the Fed’s credibility. Concerns center around possible shifts toward an inflationary policy, leading to increased long-term interest rates and investment hesitancy.

| Key Point | Details |

|---|---|

| Trump’s Relationship with Powell | President Trump has had ongoing tensions with Fed Chair Jerome Powell, critical of his policies that influence economic growth and inflation. |

| Legal Possibility of Firing | Legally, it’s ambiguous if Trump can fire Powell. The Fed Act allows removal for cause, but it’s unclear if this applies to the Fed chair. |

| Supreme Court’s Position | Recent Supreme Court rulings suggest a potential erosion of protections for independent agency leaders, but it’s uncertain how they would rule on this issue. |

| Market Reactions | The idea of firing Powell has made the markets uneasy, increasing the likelihood of inflation and undermining the Fed’s credibility. |

| Chair’s Authority | While the chair is influential, effective policy requires consensus among the Federal Open Market Committee (FOMC). |

| Potential Successor’s Impact | The identity of a successor is less crucial; removal itself could signal a shift to looser monetary policy, impacting market trust. |

Summary

Can Trump fire Fed chairman Jerome Powell? The relationship between President Trump and Fed Chair Jerome Powell has been fraught with tension, largely due to differing views on monetary policy and economic strategy. Although theoretically possible under certain interpretations of the Federal Reserve Act, any attempt to remove Powell would likely lead to significant market disruption and instability. Concerns about diminishing the Fed’s independence and credibility, combined with the potential for adverse economic consequences, suggest that it may be in the best interest of both the administration and the markets for Powell to complete his term.