The U.S. economy is currently navigating a complex landscape marked by rising tensions from trade wars and shifting consumer sentiment. Recent economic indicators have shown a decline in the consumer sentiment index, suggesting that public confidence is waning as worries about a potential U.S. recession loom. Heightened tariffs imposed in response to international trade disputes have sparked significant concerns among investors, with many fearing that the ramifications could plunge the nation into a full-blown recession. Additionally, the Federal Reserve’s decision on interest rates could play a critical role in either stabilizing or further destabilizing the economy, especially amid fears surrounding tariff policy effects. As discussions continue about the future direction of economic policy, the resilience of the U.S. economy hangs in the balance, drawing attention to both the challenges and opportunities that lie ahead.

The condition of the American financial landscape is under scrutiny as various factors converge, including trade conflicts and fluctuating public confidence. With economic indices indicating a dip in consumer optimism, analysts speculate on the repercussions of potential downturns in growth. Heightened tariffs related to ongoing international disputes may have profound impacts on market stability, leading to apprehensions regarding an impending economic contraction. Moreover, the Federal Reserve grapples with the dual challenge of adjusting interest rates in response to both inflationary pressures and the need to invigorate growth. As the nation faces these economic complexities, the broader implications for its fiscal health remain a pressing concern for policymakers and experts alike.

Analyzing the Prospects of the U.S. Economy

The future of the U.S. economy is currently shrouded in uncertainty, with a significant focus on the looming possibility of a recession. Factors such as escalating trade tensions, particularly with China and Mexico, have created a precarious situation that many analysts fear could lead to a downturn. The current administration’s aggressive tariff regime has already provoked retaliatory measures from trading partners, raising concerns about the long-term implications for economic stability. Such developments have left investors apprehensive, as they grapple with the potential fallout in consumer spending and investment.

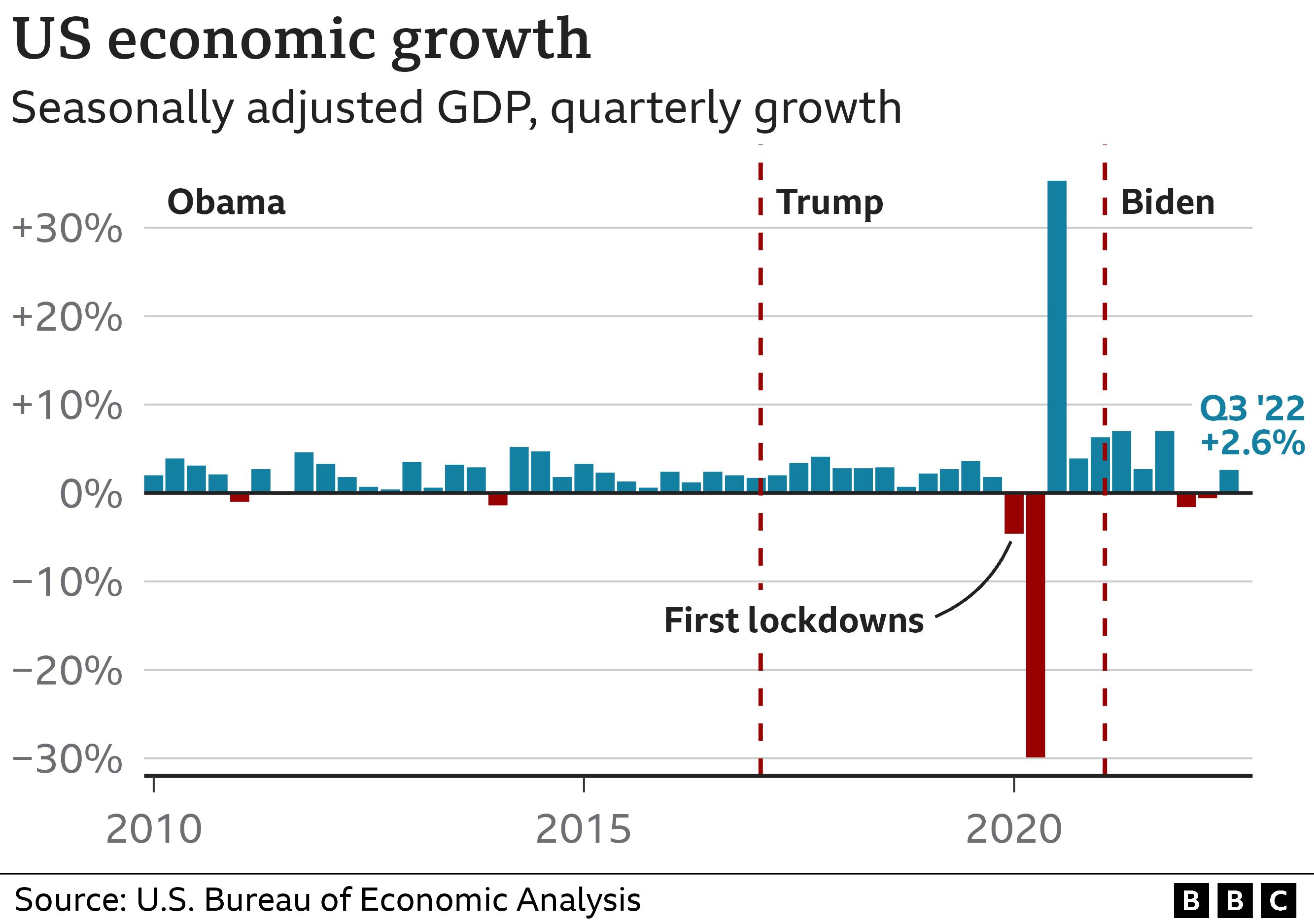

Additionally, the Federal Reserve’s interest rate policies play a crucial role in shaping the economic landscape. The ongoing tug-of-war between combating inflation and fostering job growth has left many wondering what moves the Fed will make next. As the consumer sentiment index reaches its lowest point since November 2022, the pressure mounts for the Fed to respond effectively. With tariffs impacting prices and market decisions, the interplay between these elements is vital for determining the trajectory of the U.S. economy.

The Trade War Impact on Economic Growth

The trade war initiated by the current U.S. administration has introduced significant volatility into the economy, leading to repercussions that could be felt for years. The imposition of tariffs has disrupted supply chains and increased costs for businesses, ultimately trickling down to consumers. As businesses face higher input prices, many opt to pass these costs onto customers, which may dampen consumer spending and further stifle economic growth. The resulting uncertainty has created a reactionary sentiment in the markets, leading many companies to adopt a cautious stance, putting expansion plans on hold.

Moreover, if the trade war persists, the potential for retaliatory tariffs may exacerbate the situation, affecting various sectors across the economy. For instance, industries heavily reliant on exports may face significant challenges, leading to layoffs and reduced hiring. The fears surrounding such outcomes are corroborated by rising risk perceptions among investors, reflected in stock market performances. It is clear that the trade war’s impact extends beyond mere economic indicators, affecting the psyche of consumers and businesses alike.

Consumer Sentiment and Economic Indicators

The University of Michigan’s consumer sentiment index serves as a barometer for the overall mood of the American public regarding economic conditions. As this index has dropped to its lowest level since November 2022, it signals a growing pessimism among consumers, which can potentially lead to reduced spending and investment. This decline can be attributed to various factors, including market instability due to trade tensions and rising costs of living, exacerbated by tariffs that fundamentally alter price structures for goods and services.

Consumer sentiment directly influences economic growth, as it affects spending patterns and retail performance. A pessimistic outlook can lead to decreased disposable income allocation towards consumer goods, thereby affecting business revenues and, ultimately, employment rates. Should consumer confidence continue to wane, it could foreshadow deeper economic challenges, potentially leading toward a recession as indicated by analysts. Monitoring this index closely will be fundamental to anticipating shifts in the economic landscape.

Impact of Federal Reserve Interest Rates on the Economy

The Federal Reserve’s decisions on interest rates remain a focal point in understanding the current state of the U.S. economy. With conflicting objectives of controlling inflation while supporting job growth, the Fed faces a complex dilemma. As the ramifications of tariffs extend beyond immediate economic metrics, the Fed must also consider how these policies affect overall employment and wage growth in an already cooling job market. The caution with which they approach interest rate adjustments could determine the economy’s resilience in repelling recessionary forces.

Furthermore, the Fed’s stance on interest rates often reflects broader economic sentiments. With rising inflation concerns, balancing rate cuts with the need to keep inflation expectations anchored is crucial. Rate adjustments can influence everything from consumer borrowing to business investments, creating a ripple effect across the economy. Therefore, the Fed’s next moves are being watched closely, as any change will signal how seriously they are taking the threats posed by the ongoing trade war and fluctuating consumer sentiment.

Understanding Tariff Policy Effects on the U.S. Economy

Tariff policies implemented by the U.S. have significant implications for the economy, both domestically and globally. While proponents argue that tariffs can protect American jobs and industries, the reality often reveals a more complicated picture. Increased tariffs tend to raise the cost of imported goods, leading to higher prices for consumers and potential retaliation from trade partners. This tit-for-tat dynamic prolongs uncertainty in markets, influencing investor behavior and consumer confidence, which are critical for sustained economic growth.

Moreover, the impact of tariffs is not limited to pricing; they affect broader economic dynamics such as trade balances and employment rates. Industries that depend heavily on international supply chains are particularly vulnerable, as tariff-induced cost increases might lead companies to consider relocating or streamlining operations to manage costs. Understanding these effects on the U.S. economy will be essential in predicting how the current tariff policies might reshape market landscapes and consumer experiences over time.

Recession Risks: Are We Prepared?

With recession risks heightening, it is critical for policymakers, investors, and consumers to assess preparedness for potential economic downturns. Various indicators suggest that the U.S. economy faces substantial challenges ahead, including volatility due to trade wars and fluctuating consumer sentiment. Economists are raising alarms about the possible onset of recession within the next year, determining factors such as stock market performance, employment rates, and government spending as key indicators to monitor.

Preparing for a potential recession involves understanding the complexities of current economic conditions, including the impact of the Federal Reserve’s interest rates as they navigate inflation control while supporting economic growth. The uncertainties brought about by tariff policies and international trade relations further complicate the landscape, necessitating a proactive approach to economic planning. As risks increase, awareness and strategic foresight will be essential in mitigating negative impacts on the U.S. economy.

Navigating Economic Uncertainty with Strategic Policies

In navigating the turbulent waters of economic uncertainty, strategic policy-making becomes paramount in fostering stability and growth within the U.S. economy. Policymakers must work collaboratively to mitigate the impact of trade wars and tariff policies that have shown to create significant strife in various industries. Engaging in diplomatic negotiations to reduce trade barriers and fostering a cooperative global economic environment could alleviate some pressures while promoting sustainable growth.

Moreover, there should be a focus on developing supportive measures for affected industries and consumers. Policies aimed at stimulating job growth, strengthening social safety nets, and ensuring access to affordable goods are crucial in minimizing the immediate effects of economic downturns. As uncertainty prevails, reinforcing the foundation of the U.S. economy will require innovative approaches to economic policy that prioritize resilience and adaptability amid shifting market dynamics.

Long-Term Economic Growth Solutions Needed

The discussion on long-term economic growth solutions is becoming increasingly vital as the U.S. faces potential recession risks compounded by external pressures like international trade conflicts. Economists emphasize the necessity for structural reforms that target underlying issues contributing to economic instability. Strategies may include investing in infrastructure, enhancing workforce skills, and fostering innovation to drive productivity and competitiveness in the global marketplace.

Furthermore, maintaining an open dialogue on trade relations and economic policies will serve as a foundation for sustainable growth. It is imperative that the U.S. embraces collaborative approaches that facilitate fair trade practices while protecting local industries. By focusing on these long-term growth solutions, the U.S. can not only mitigate the harsh impacts of short-term economic fluctuations but also lay a strong groundwork for future prosperity.

The Role of Government in Economic Recovery

The role of government in economic recovery is a critical factor amidst the current challenges facing the U.S. economy. As concerns mount regarding the impacts of the trade war and potential recession, government intervention measures become essential. Proactive fiscal policies that prioritize economic stimulus can help revitalizing spending and bolster consumer confidence, which is pivotal for driving economic growth during turbulent times.

Moreover, the government can facilitate economic recovery by providing support to sectors most affected by tariff policies and trade disruptions. Implementing programs aimed at assisting businesses with financial resilience can pave the way for growth and stability in the wider economy. In addressing these needs, transparency and effective communication will be crucial to restore public trust and ensure a coordinated response to economic headwinds.

Frequently Asked Questions

What impact will the U.S. recession have on consumer spending and the economy?

The U.S. recession could significantly decrease consumer spending, which is a critical driver of economic growth. As consumer sentiment declines, indicated by drops in indices like the consumer sentiment index, people become more cautious with their spending. This can lead to reduced demand for goods and services, further hurting businesses and potentially leading to higher unemployment rates.

How does the Federal Reserve’s management of interest rates influence the U.S. economy?

The Federal Reserve’s interest rates directly affect borrowing costs for consumers and businesses. If the Fed cuts rates to stimulate the economy during uncertain times, it may help encourage spending and investment. However, persistent inflationary pressures could lead the Fed to maintain higher rates to stabilize the economy, creating a delicate balance that impacts overall economic growth.

What are the tariff policy effects on the U.S. economy and its international trade relations?

Tariff policy effects can lead to increased costs for imported goods, which may result in higher prices for consumers and businesses in the U.S. Furthermore, such policies can trigger retaliatory measures from trading partners, exacerbating tensions and potentially leading to a trade war that negatively affects economic growth and international trade relations.

What role does consumer sentiment index play in predicting the U.S. economy’s performance?

The consumer sentiment index is a key indicator of how optimistic or pessimistic consumers feel about the current economic situation and their financial futures. A declining index suggests that consumers may cut back on spending, which can slow down economic growth and even signal the onset of a recession if negative sentiment persists.

How can the trade war impact the U.S. economy in the long term?

A prolonged trade war can create uncertainty in the U.S. economy, affecting investment decisions and leading to decreased growth. Tariffs may shield some domestic industries temporarily, but they often lead to higher prices and retaliatory tariffs that impact other sectors, potentially exacerbating risks of recession and stunting overall economic advancement.

| Key Point | Details |

|---|---|

| U.S. Economy Outlook | Heavy market losses due to tariffs and fears of a recession. |

| Trade War Concerns | Responses from China, Mexico, and Canada could escalate trade tensions. |

| Consumer Sentiment | University of Michigan’s index shows lowest confidence since Nov 2022. |

| Federal Reserve’s Dilemma | Debate on interest rate cuts vs. controlling inflation amidst economic risks. |

| Tariff Debate | Economist Jeffrey Frankel argues tariffs are generally bad for the economy. |

| Risks of Recession | Five factors that could lead to a recession in the near future. |

| Economic Recovery Challenges | Uncertainty affects employment, income, and investment decisions. |

| Implications for Policy | Fed’s struggle with balancing inflation control and economic support. |

Summary

The U.S. economy faces significant challenges as these current events unfold. With fears of a recession looming due to a volatile trade war, sluggish consumer sentiment, and pressures from the Federal Reserve on monetary policy, many factors are at play that could impact the future economic landscape. As uncertainties prevail, both businesses and investors are in a state of apprehension, further complicating recovery efforts. Addressing these issues promptly and effectively is crucial to restoring confidence in the U.S. economy.